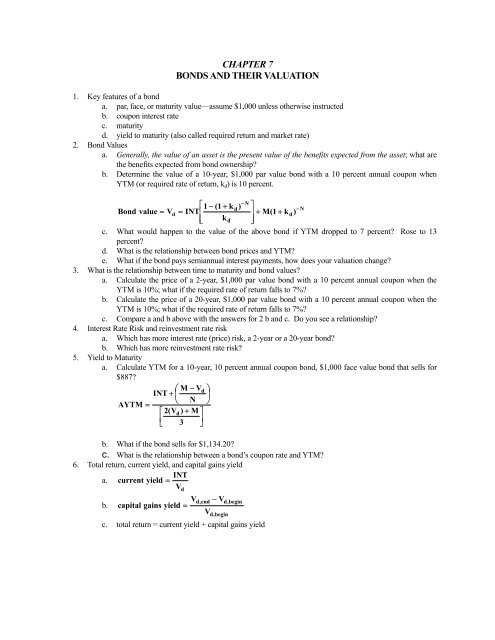

42 relationship between coupon rate and ytm

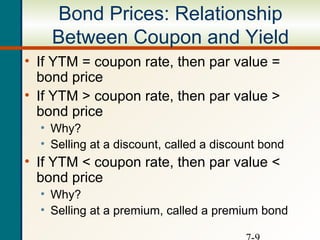

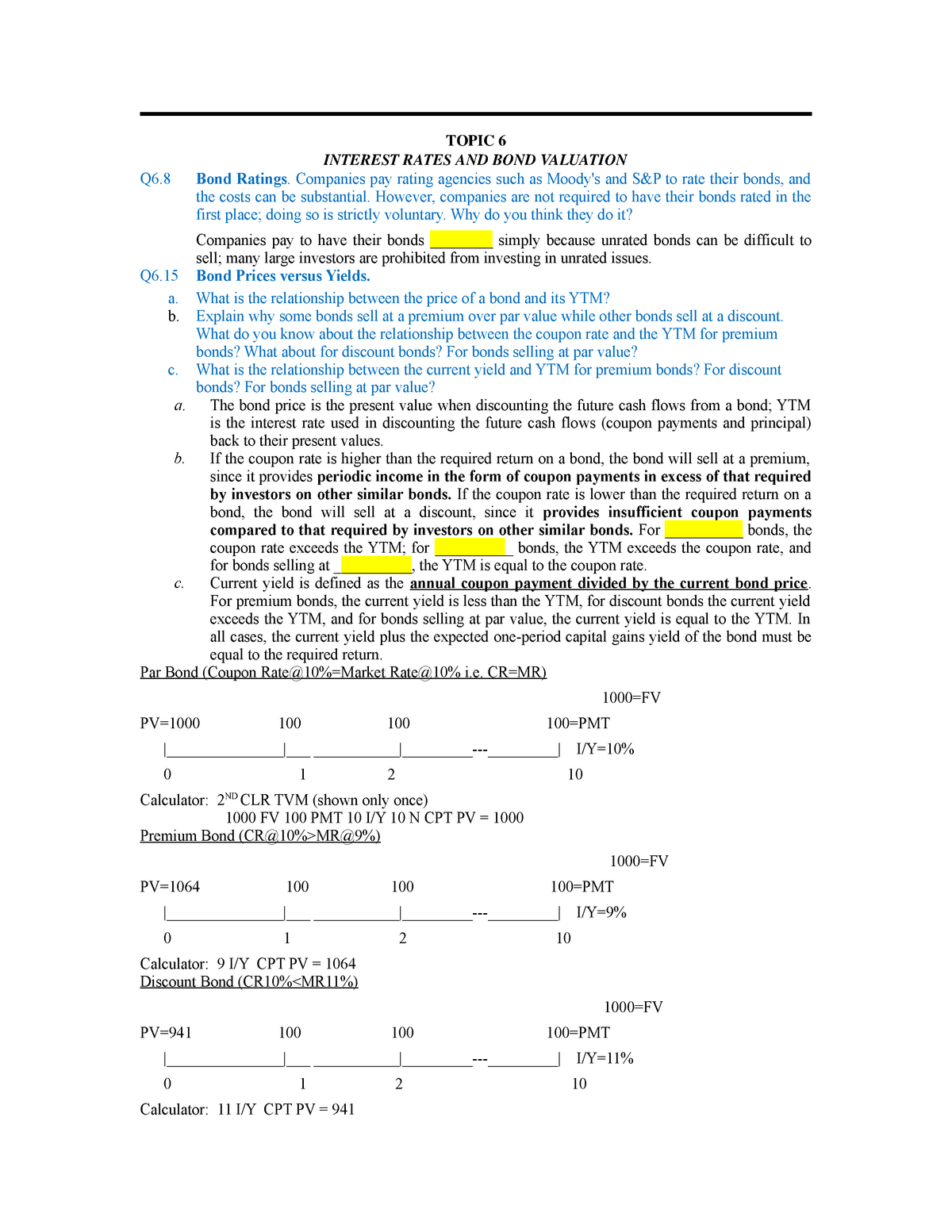

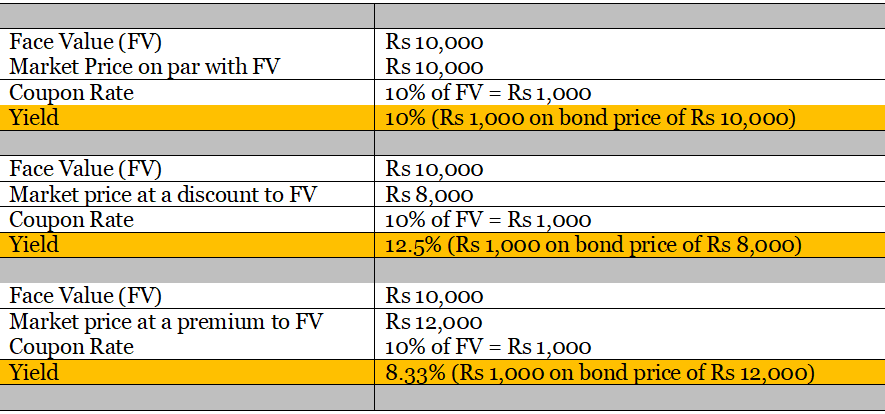

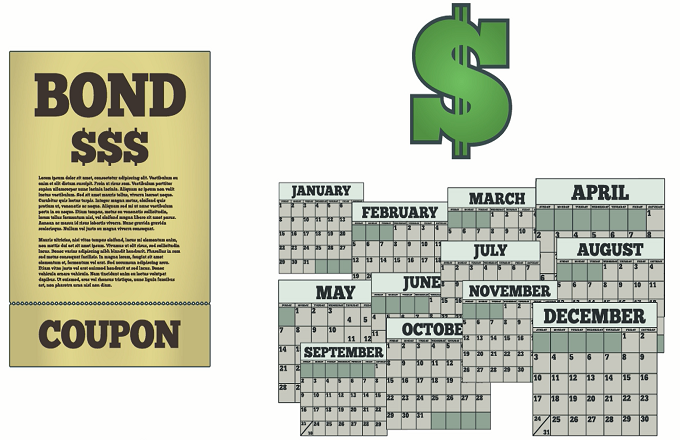

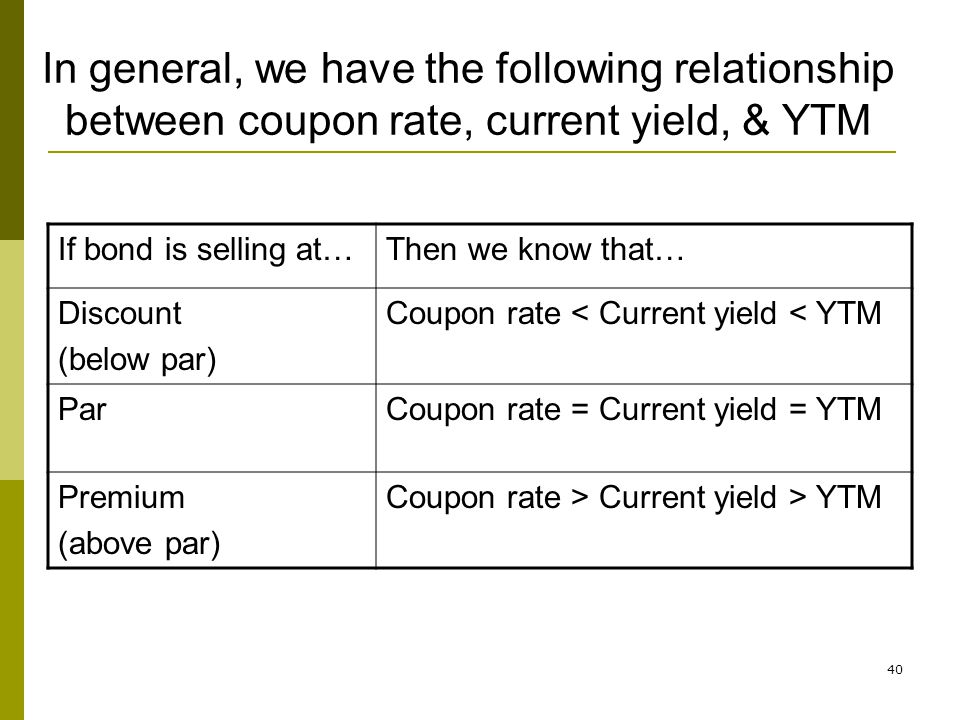

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ... Chapter 10 concept questions Flashcards | Quizlet In any present value calculation, the present value declines when the interest rate increases. a) What is the relationship between the price of a bond and its YTM? (b) Explain why some bonds sell at a premium to par value, and other bonds sell at a discount. What do you know about the relationship between the coupon rate and the YTM for premium ...

Relationship Between Coupon and Yield - Assignment Worker YTM with Semiannual Coupons. 40 N. 1197.93 PV (negative) 1000 FV. 50 PMT. CPT PV 4% (= ½ YTM) YTM = 4%*2 = 8%. NOTE: Solving a semi-annual payer for YTM. results in a 6-month yield. The calculator & Excel. solve what you enter. The 4% value is the 6-month interest rate. YTM is an annual rate.

Relationship between coupon rate and ytm

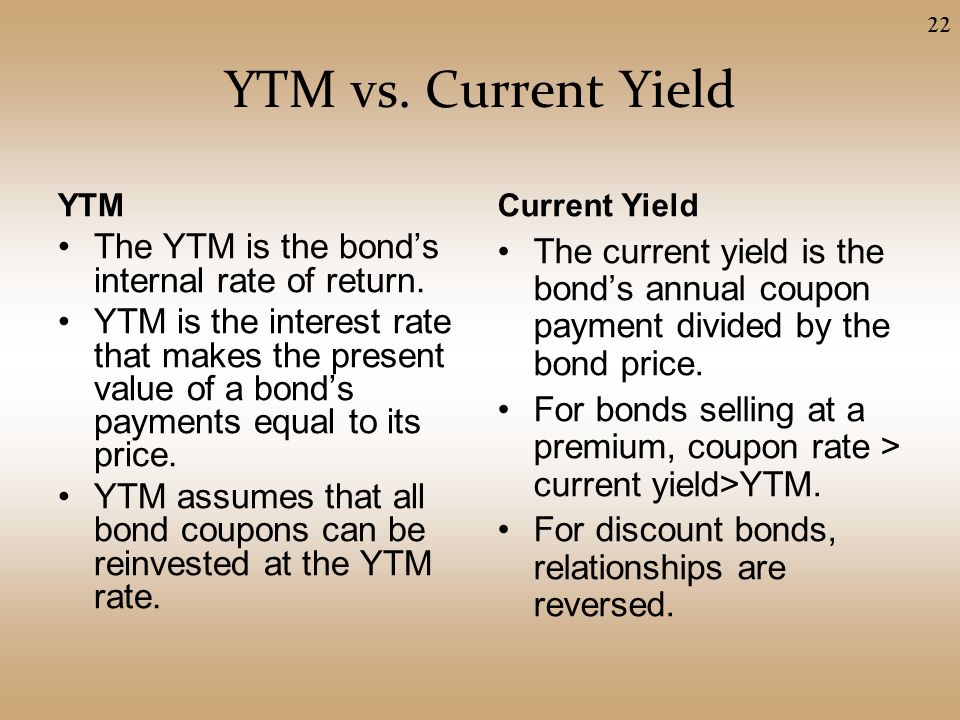

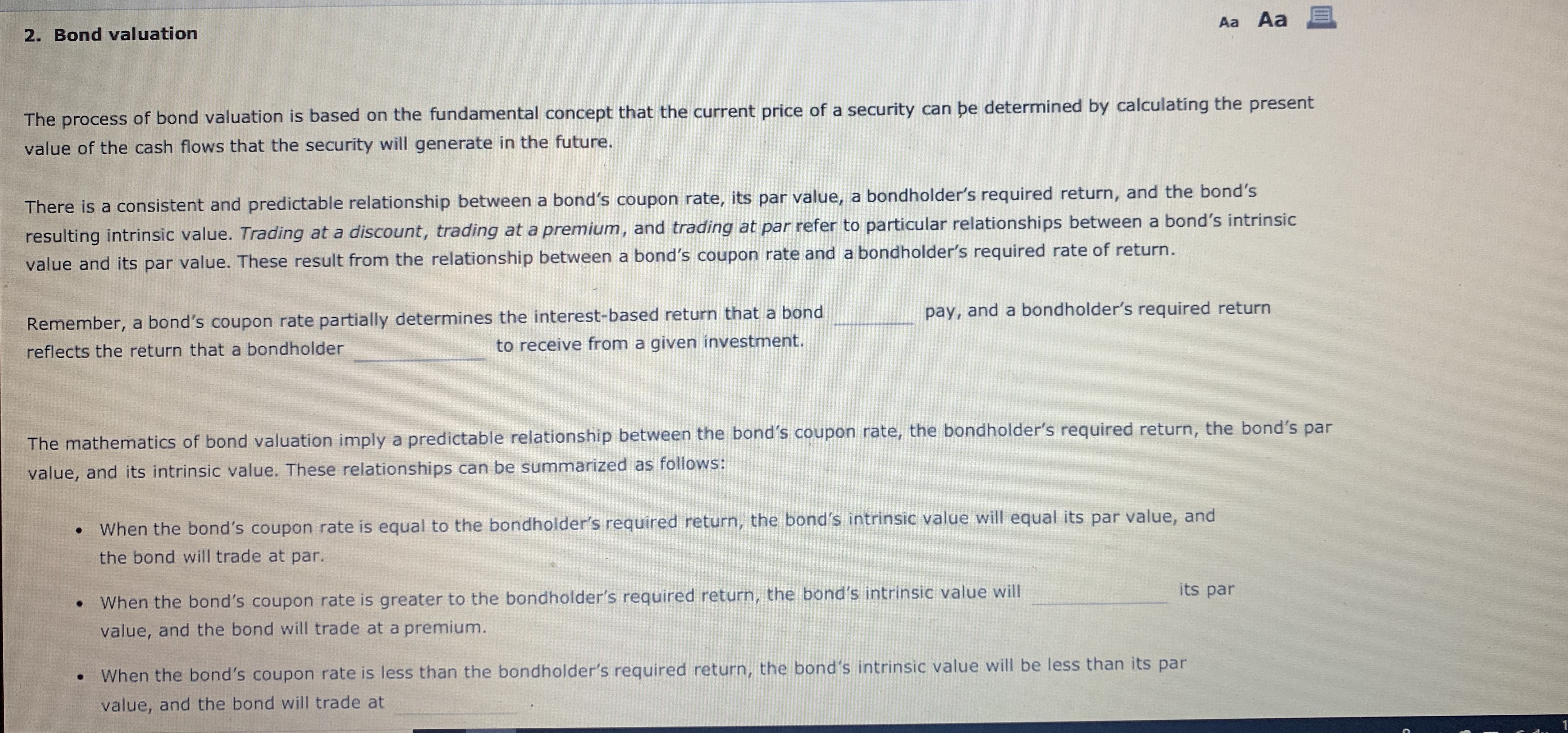

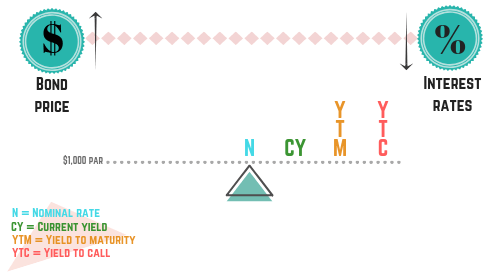

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond. Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Relationship Between Yield To Maturity and Coupon Rate - LiquiSearch Current Yield - Relationship Between Yield To Maturity and Coupon Rate Relationship Between Yield To Maturity and Coupon Rate The concept of current yield is closely related to other bond concepts, including yield to maturity, and coupon yield. When a bond sells at; a discount: YTM > current yield > coupon yield

Relationship between coupon rate and ytm. Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 Study Notes Suppose we receive a semi-annual coupon at the rate of USD 3 per annum forever. Suppose further that the yield to maturity is 6%. Then, the present value of the perpetuity is $$\frac{3}{0.06}=\text{USD 50}$$ The Relationship between Spot Rates and YTM. We can use both the spot rate and the yield to maturity to determine the fair market price of ... The Relation of Interest Rate & Yield to Maturity | Pocketsense Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and maturity date. In the example, if you paid a premium for the same six-year bond, say $101, your estimated YTM would decrease to about 4.8 percent, or about $28.80. If a bond is trading at a premium, what is the relationship between the ... A bond purchased at a premium, it will have a yield to maturity and current yield that is lower than its coupon rate.. What is a Premium bond? This is usually above its face value which may be as a result of the interest rate being higher than the current market interest rates.. When a bond is traded at a premium, the yield to maturity and current yield will be lower than its coupon rate. What relationship between a bond's coupon rate and a bond's yield would ... Let's say you own a bond that you paid $1,000 for and it has a coupon rate of 10%. That means that this Bond will pay $100 per year in interest no matter what its price on the market. Therefore , your yield is also 10%. Now let's say that there is exactly one year left on this Bond. That is, this Bond will mature in exactly one year.

Relationship between bond price and YTM - brainmass.com The yield to maturity (YTM) is the required return by the investor on the bond. It is calculated by discounting the expected cash flows by the required return an dequating these discounted cash flows to the price of the bond. The relationship can be expressed matematically as. Price=Discounted Cash Flows (Interest+Principal) at rate Kd. The Relationship Between a Bond's Price & Yield to Maturity If you pay $1,000 for this bond, your yield to maturity will be exactly 6 percent, as you will receive the exact amount of money you originally paid for the bond. However, if you only pay $900 for the bond, your yield to maturity will be greater because, in addition to the 6 percent interest, you'll earn a capital gain of $100. Basis Point Value - Overview, Bond Yields and Prices The par value of the bond must also be repaid by the issuer on the date of maturity. Therefore, bond yield can be calculated by dividing the total coupon payments by the face value of the bond. Yield to Maturity (YTM) However, simply using coupon rates and face value is an incomplete calculation of total bond yield. Relationship Between Yield To Maturity and Coupon Rate - LiquiSearch Current Yield - Relationship Between Yield To Maturity and Coupon Rate Relationship Between Yield To Maturity and Coupon Rate The concept of current yield is closely related to other bond concepts, including yield to maturity, and coupon yield. When a bond sells at; a discount: YTM > current yield > coupon yield

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%. Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "42 relationship between coupon rate and ytm"