41 us treasury coupon rate

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury … Treasury's Certified Interest Rates — TreasuryDirect A .gov website belongs to an official government organization in the United States. Secure .gov websites use HTTPS A lock or ... Quarterly Interest Rate Certification Semi-Annual Interest Rate Certification Annual Interest Rate Certification Continued Treasury Zero Coupon Spot Rates Average Interest Rates on U.S. Treasury Securities UTF ...

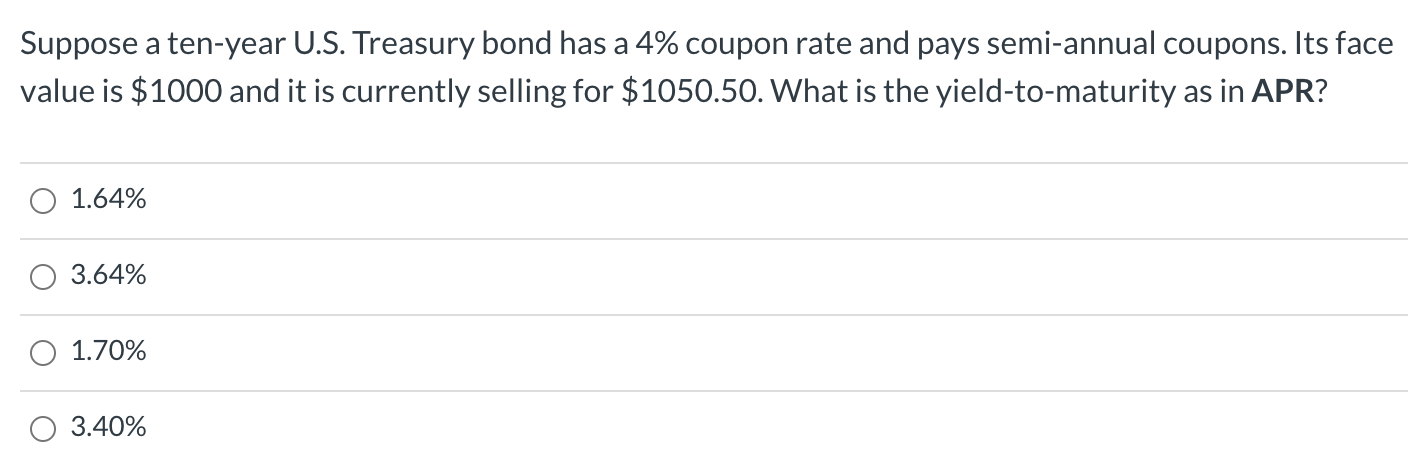

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

Us treasury coupon rate

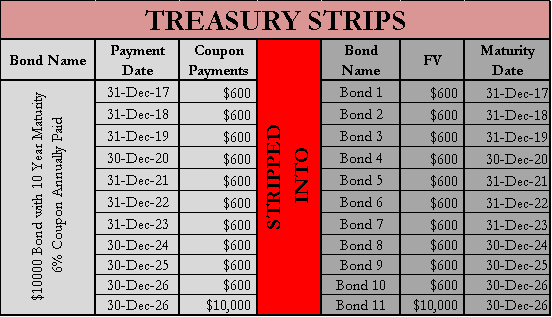

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis. Ukraine-/Russia-related Sanctions | U.S. Department of the Treasury Exchange Rate Analysis. U.S.-China Comprehensive Strategic Economic Dialogue (CED) ... Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. ... General licenses allow all US persons to engage in the activity described in the general license without needing to apply for a specific license. How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by ...

Us treasury coupon rate. U.S. Treasury Sanctions Notorious Virtual Currency Mixer Tornado … May 06, 2022 · WASHINGTON – Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned virtual currency mixer Tornado Cash, which has been used to launder more than $7 billion worth of virtual currency since its creation in 2019. This includes over $455 million stolen by the Lazarus Group, a Democratic People’s Republic of Korea (DPRK) … Foreign Account Tax Compliance Act | U.S. Department of the Treasury Statement between the US Department of the Treasury and the Authorities of Japan to Implement FATCA (6-11-2013) Joint Communiqué on the Occasion of the Publication of the Model Agreement (France, Germany, Italy, Spain and the UK) (7-25-2012) Joint Statement from the US and Japan (6-21-2012) Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an... United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

Interest Rates - U.S. Department of the Treasury APY = 1.081600 -1 APY = 0.081600 And, expressed as a percent: APY = 8.16% Are the CMT rates used to set Adjustable Rate Mortgage (ARM) rates? Treasury does not make the determination as to which, if any, CMT rate index is used to set an ARM rate. ARM rates are set by the financial institution that made or holds the mortgage. Front page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. ... Enhancing the US-UK Sanctions Partnership. October 4, 2022 ... Treasury Long-Term Rates and Extrapolation Factors, and Treasury Real Long-Term Rate Averages. View This Data. Daily Treasury Par Yield Curve CMT Rates. 10/31/2022. 1 Month . 3.73. 2 Month . 4.00. 3 ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways Coupon rates are the... What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Specially Designated Nationals And Blocked Persons List (SDN) … Interest Rate Statistics. Treasury Securities. Treasury Investor Data. Debt Management Research. Financial Markets, Financial Institutions, and Fiscal Service ... Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. ... Enhancing the US-UK Sanctions Partnership. October 4, 2022 ... Understanding Pricing and Interest Rates — TreasuryDirect Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes I bonds — TreasuryDirect Tax information for EE and I savings bonds. Using savings bonds for higher education. How much does an I bond cost? Electronic I bonds: $25 minimum or any amount above that to the penny. For example, you could buy an I bond for $36.73. Paper I bonds: $50, $100, $200, $500, or $1,000. home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Macroeconomic and Foreign Exchange Policies of Major Trading … Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. ... The Treasury Department’s semiannual Report to Congress reviews developments in international economic and exchange rate policies across the United States’ major trading partners. June 2022 Report. Authorizing Statute (2015) ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

Treasury Notes — TreasuryDirect Maximum purchase. $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency. 2, 3, 5, and 7-year notes: Monthly. 10-year notes: Feb., May, Aug., Nov. Reopenings of 10-year notes: 8 times/year. See the Auction calendar for specific dates.

› us-treasury-bondsUS Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued.

home.treasury.gov › policy-issues › tax-policyForeign Account Tax Compliance Act | U.S. Department of the ... Statement between the US Department of the Treasury and the Authorities of Japan to Implement FATCA (6-11-2013) Joint Communiqué on the Occasion of the Publication of the Model Agreement (France, Germany, Italy, Spain and the UK) (7-25-2012) Joint Statement from the US and Japan (6-21-2012)

Nasdaq Data Link Here are some further options for you: Return to the Nasdaq Data Link home page.; See our premium data publishers.; Read our help pages.; Thank you for using Nasdaq Data Link!

time.com › nextadvisorHome | NextAdvisor with TIME NextUp. The 25 Most Influential New Voices of Money. This is NextUp: your guide to the future of financial advice and connection. Explore the list and hear their stories.

Treasury Bill Rates - Nasdaq Treasury Bill Rates. From the data product: US Treasury (12 datasets) Refreshed 10 hours ago, on 27 Oct 2022 ... The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year. The Coupon Equivalent can be used to compare the yield on a ...

What Is a Treasury Note? How Treasury Notes Work for Beginners What Do Treasury Notes Pay? Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields Treasury bonds, bills, and notes will all have varying yields. Longer-term Treasury securities typically yield higher returns than shorter-term Treasury securities.

› ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Coupon rates are largely influenced by prevailing national government-controlled interest rates, as reflected in government-issued bonds (like the United States' U.S. Treasury bonds

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

home.treasury.gov › news › featured-storiesFACT SHEET: The American Rescue Plan Will Deliver Immediate ... Mar 18, 2021 · The current public health crisis and resulting economic crisis have devastated the health and economic wellbeing of millions of Americans. From big cities to small towns, Americans – particularly people of color, immigrants, and low-wage workers – are facing a deep economic crisis. More than 9.5 million workers have lost their jobs in the wake of the pandemic, with 4 million out of work ...

Resource Center | U.S. Department of the Treasury The Committee on Foreign Investment in the United States (CFIUS) Exchange Stabilization Fund. G-7 and G-20. ... Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues.

30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year treasury yield as of October 27, 2022 is 4.12%.

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by ...

Ukraine-/Russia-related Sanctions | U.S. Department of the Treasury Exchange Rate Analysis. U.S.-China Comprehensive Strategic Economic Dialogue (CED) ... Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. ... General licenses allow all US persons to engage in the activity described in the general license without needing to apply for a specific license.

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis.

:max_bytes(150000):strip_icc()/GettyImages-172745598-5756f5bd3df78c9b46977f64.jpg)

Post a Comment for "41 us treasury coupon rate"