40 coupon value of a bond

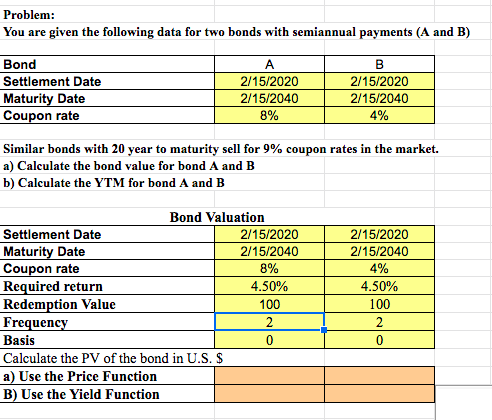

› terms › cWhat Is a Bond Coupon, and How Is It Calculated? - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value,... Coupon Bond - Guide, Examples, How Coupon Bonds Work If there is a high probability of default, investors may require a higher rate of return on the bond. Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate i = Interest rate n = number of payments

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

Coupon value of a bond

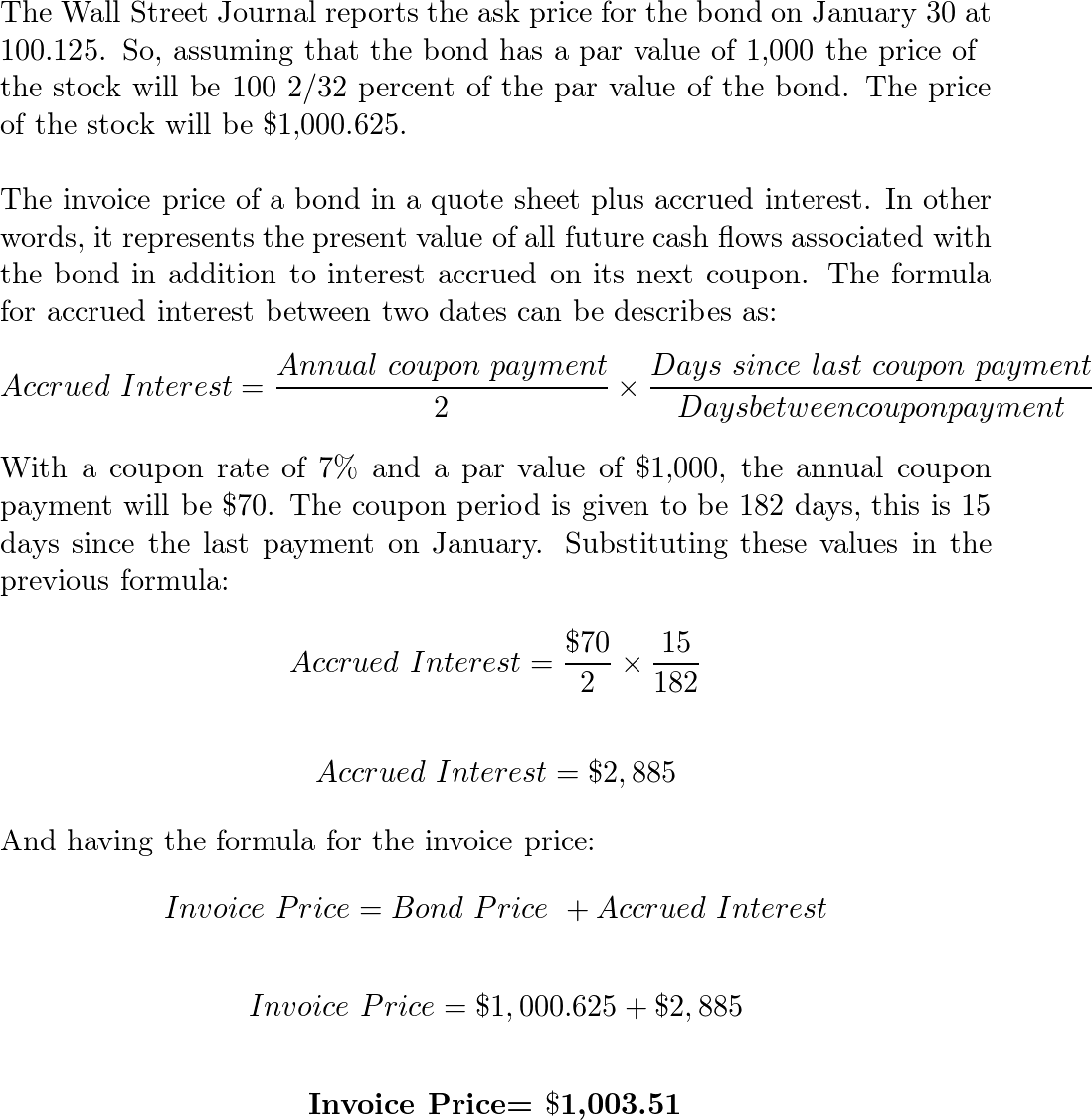

What is coupon on bonds? - moneycontrol.com Nov 24, 12:11. Coupon rate on the bonds is nothing but the rate of interest paid by the issuers to the investors on the bond's face value. The coupon rate is the annualised interest amount. Coupon ... Key Differences: Bond Price vs. Yield - SmartAsset Coupon (or Nominal) Yield - Suppose someone buys a one-year bond with a face value of $1,000 bond and an annual coupon of $50. Holding that bond for one year (to maturity) would result in a yield of 5%. That would be its coupon yield or nominal yield. Current Yield - But now consider how yield changes if the price of that same bond falls. How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow WebDec 10, 2021 · For example, pretend you purchased a bond with a face value of $1000. This bond pays you a 5% coupon, or $50 per year. Pretend now that the price of your bond dropped to $500 in the first year due to a change in interest rates in the marketplace. The yield would then be 10%. Since a bond's yield is the coupon payment as a percent of its …

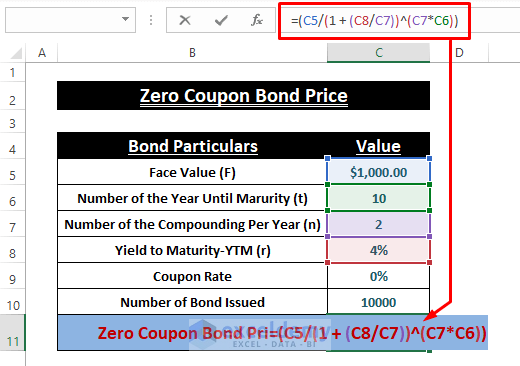

Coupon value of a bond. Understanding Bond Prices and Yields - Investopedia WebJun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. ... Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase ... › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Calculation of the Value of Bonds (With Formula) - Your Article Library Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. The bond has a six year maturity value and has a premium of 10%. If the required rate of returns is 17% the value of the bond will be: = Rs 15 (PVAF 17%6 Years )+110 (PVDF 17% 6 years ), = Rs. 15 x (3.589) +110 (.390) Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84 dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The par value of the bond is $1,000, coupon rate of 6%, and a number of years until maturity in 6 years. Determine the price of the CB if the yield to maturity is 7%. Solution: Given,Par value, P = $1,000; Yield to maturity, YTM = 7%; Since the coupon is paid semi-annually,

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Coupon Rate Definition - Investopedia WebMay 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo WebFor example, if a bond with a face value of $1,000 offers a coupon rate of 5%, then the bond will pay $50 to the bondholder until its maturity. The annual interest payment will continue to remain $50 for the entire life of the bond until its maturity date irrespective of the rise or fall in the market value of the bond.

› Calculate-an-Interest-Payment-onHow to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · For example, pretend you purchased a bond with a face value of $1000. This bond pays you a 5% coupon, or $50 per year. Pretend now that the price of your bond dropped to $500 in the first year due to a change in interest rates in the marketplace. The yield would then be 10%. Since a bond's yield is the coupon payment as a percent of its current ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas WebAfter 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%. Every year, the bond will pay you 5% of its value, or $5, until it expires in a decade. That active payment occurs on a fixed basis, usually twice a year. Historically, when investors purchased a bond they would receive a sheet of paper coupons.

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Coupon Bond: Definition, How They Work, Example, and Use Today Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This...

Gazprom Make Coupon Payment on EUR Bonds; Bonds Trend Higher Gazprom's Gaz Capital made a coupon payment on its outstanding €560.3mn bonds due 2023 as per a statement. Bloomberg notes that Gazprom earlier cancelled €439.7mn worth of notes by issuing "substitute" domestic bonds. Separately, a Swedish arbitration court has ordered Finnish state-owned energy company Gasum to pay Gazprom over €300mn ($310mn) for late payment on gas supplies, as ...

What Is a Zero-Coupon Bond? - Investopedia WebMay 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Bond (finance) - Wikipedia WebIn finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often …

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Zero-coupon bond - Wikipedia WebA zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero …

Zero Coupon Bond Calculator – What is the Market Value? WebP: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Coupon Bond: Definition, How They Work, Example, and Use Today WebMar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... For example, if a bond with a face value of $1,000 offers a coupon rate of 5%, then the bond will pay $50 to the bondholder until its maturity. The annual interest payment will continue to remain $50 for the entire life of the bond until its maturity date irrespective of the rise or fall in the market value of the bond.

How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow WebDec 10, 2021 · For example, pretend you purchased a bond with a face value of $1000. This bond pays you a 5% coupon, or $50 per year. Pretend now that the price of your bond dropped to $500 in the first year due to a change in interest rates in the marketplace. The yield would then be 10%. Since a bond's yield is the coupon payment as a percent of its …

Key Differences: Bond Price vs. Yield - SmartAsset Coupon (or Nominal) Yield - Suppose someone buys a one-year bond with a face value of $1,000 bond and an annual coupon of $50. Holding that bond for one year (to maturity) would result in a yield of 5%. That would be its coupon yield or nominal yield. Current Yield - But now consider how yield changes if the price of that same bond falls.

What is coupon on bonds? - moneycontrol.com Nov 24, 12:11. Coupon rate on the bonds is nothing but the rate of interest paid by the issuers to the investors on the bond's face value. The coupon rate is the annualised interest amount. Coupon ...

Post a Comment for "40 coupon value of a bond"