38 treasury bills coupon rate

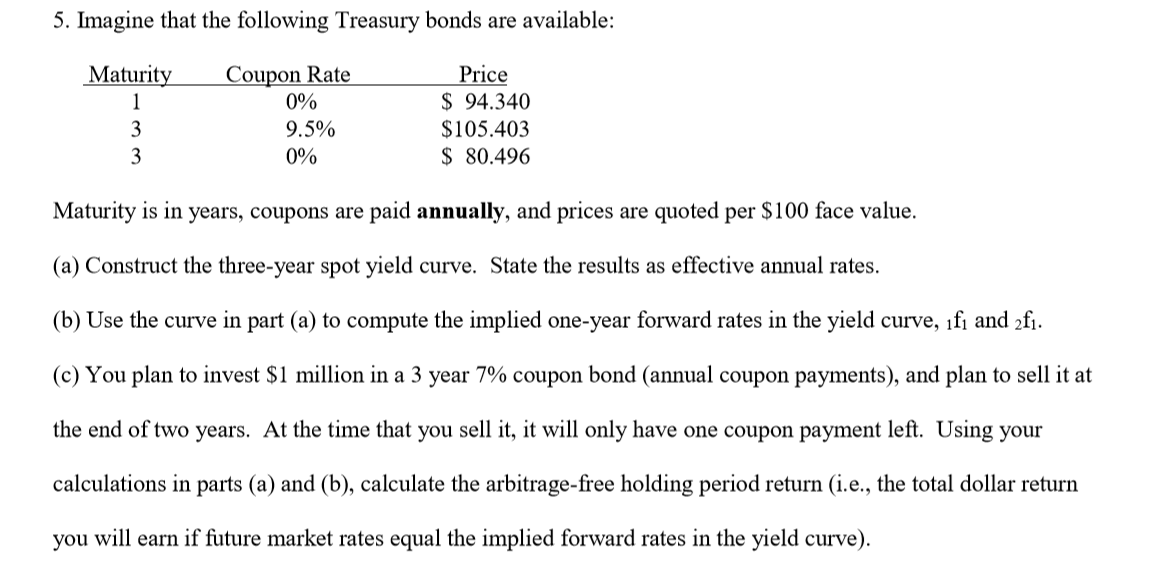

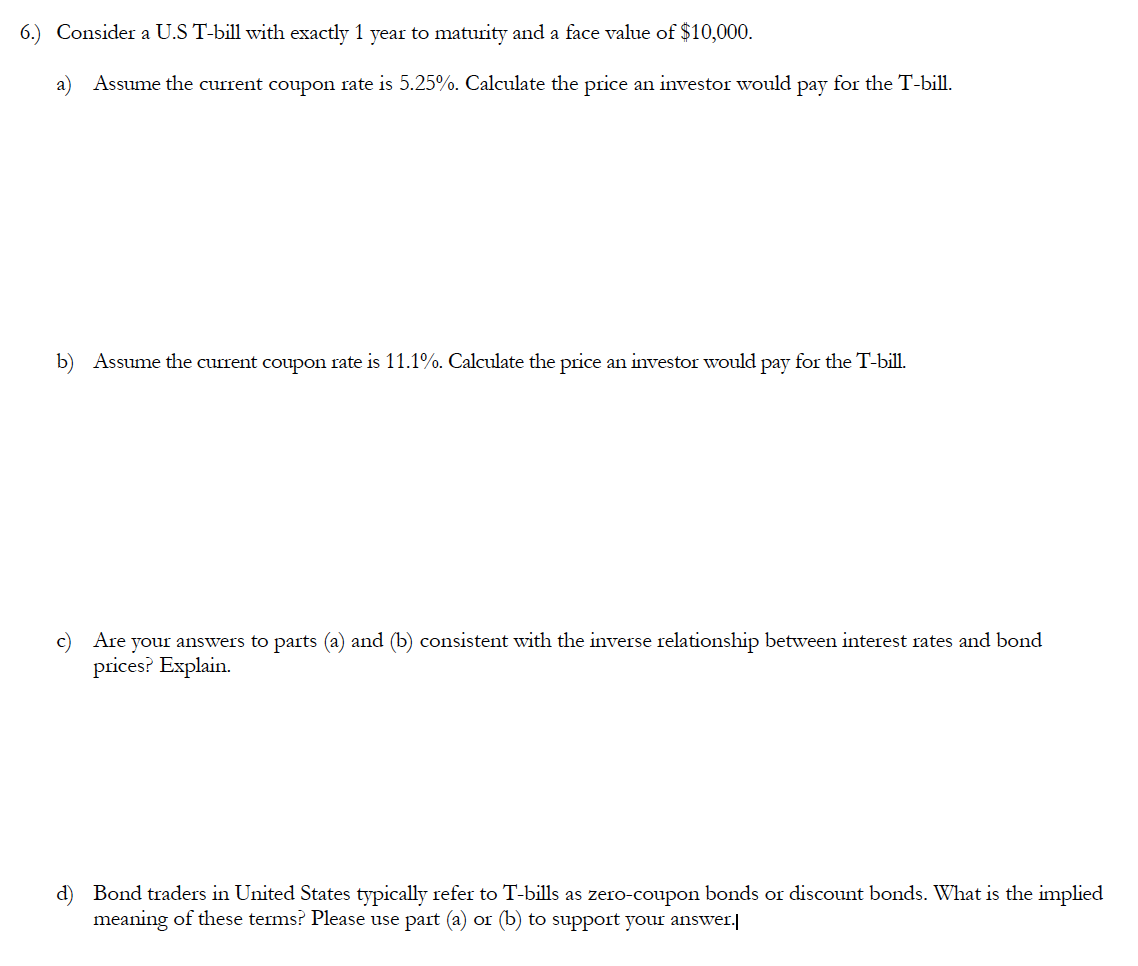

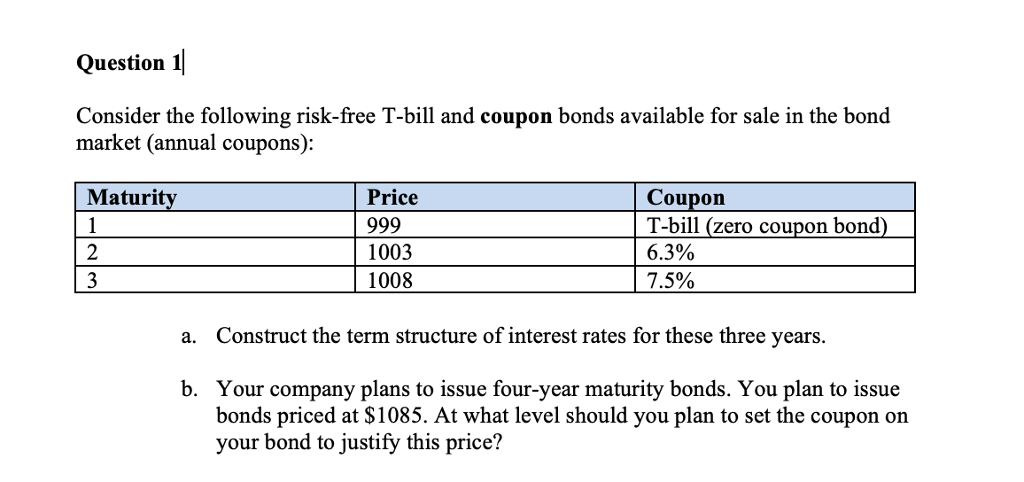

Understanding Pricing and Interest Rates — TreasuryDirect To see what the purchase price will be for a particular discount rate, use the formula: Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. Coupon Equivalent Rate (CER) Definition - Investopedia For example, a $10,000 US T-bill that matures in 91 days is selling for $9,800. Its coupon equivalent rate would be 8.08%, or ( ($10,000 - $9,800) / ($9,800)) * (360 / 91), which is 0.0204 *...

Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week.

Treasury bills coupon rate

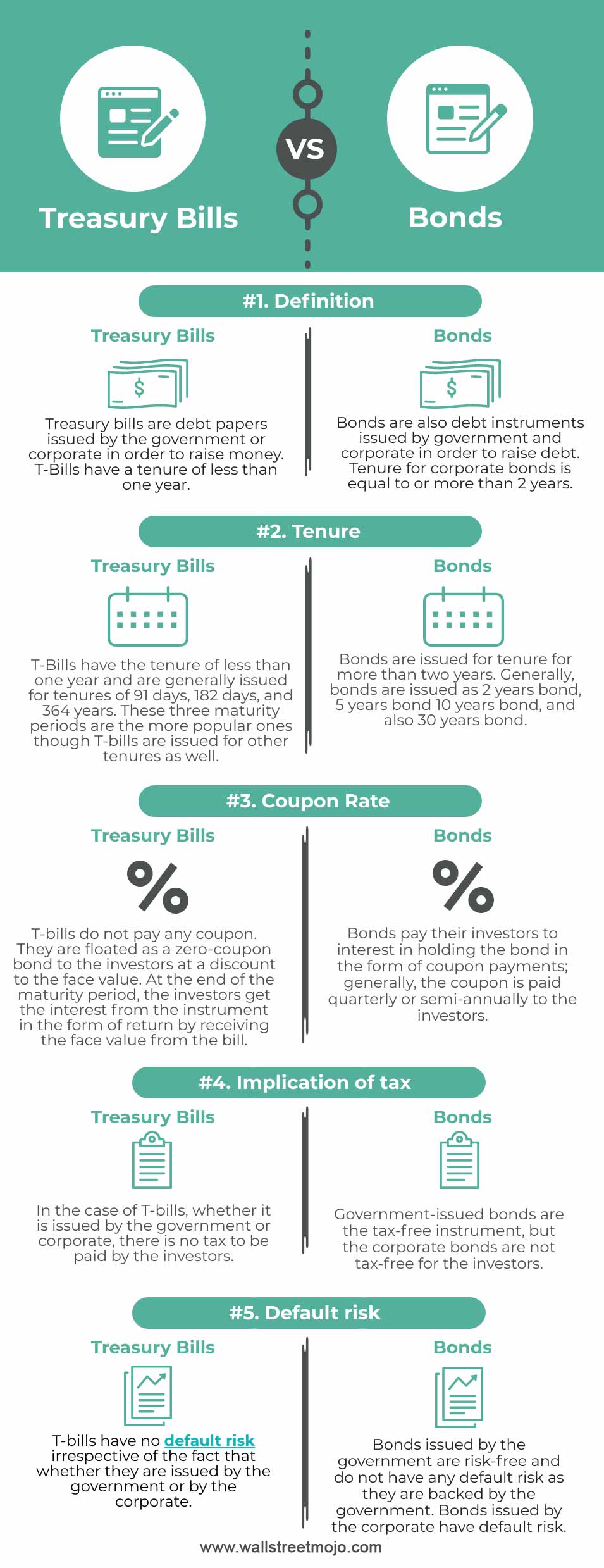

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Treasuries - WSJ Market Data Center on The Wall Street Journal. Treasury Notes — TreasuryDirect Maximum purchase. $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency. 2, 3, 5, and 7-year notes: Monthly. 10-year notes: Feb., May, Aug., Nov. Reopenings of 10-year notes: 8 times/year. See the Auction calendar for specific dates.

Treasury bills coupon rate. How Are Treasury Bill Interest Rates Determined? - Investopedia After the investor receives the $1,000 at the end of the 52 weeks, the interest rate earned is 2.56%, or 25 / 975 = 0.0256. The interest rate earned on a T-bill is not necessarily equal to... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S.... United States Rates & Bonds - Bloomberg Treasury Inflation Protected Securities (TIPS) Name Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year . 1.63: ... Rate Current 1 Year Prior; FDFD:IND . Fed Funds Rate . 3.82: home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

Debt Limit | U.S. Department of the Treasury The debt limit does not authorize new spending commitments. It simply allows the government to finance existing legal obligations that Congresses and presidents of both parties have made in the past. Failing to increase the debt limit would have catastrophic economic consequences. It would cause the government to default on its legal obligations – an unprecedented event in American … Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... The image below pulls the prevailing bond prices for United States Treasury bills and bonds with varying maturities. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to... › treasury-t-bills-investmentTreasury Bills (T-Bills) - What They Are & How to Buy for ... Sep 14, 2021 · However, unlike other offerings by the Treasury, they offer very short terms, greatly reducing the interest-rate risk associated with investing in fixed-income securities. T-bills mature in less than one year, whereas investments in Treasury notes mature in one to 10 years and investments in Treasury bonds typically take 30 years to mature.

OFAC Recent Actions | U.S. Department of the Treasury Interest Rate Statistics. Treasury Securities. Treasury Investor Data. Debt Management Research. Financial Markets, Financial Institutions, and Fiscal Service. Cash and Debt Forecasting. ... Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Press Releases | U.S. Department of the Treasury Interest Rate Statistics. Treasury Securities. Treasury Investor Data. Debt Management Research. Financial Markets, Financial Institutions, and Fiscal Service. Cash and Debt Forecasting. ... Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Receipts & Outlays. Monthly Treasury Statement. Treasury Bills (T-Bills) - What They Are & How to Buy for … Sep 14, 2021 · Treasury bills (T-bills) are a great way to put your hard-earned dollars to work for you. ... While most fixed-income securities like bonds pay interest in the form of coupon rates, there is no interest offered when investing in T-bills. When a T-bill matures, investors receive the full face value of the bill, often referred to as the par value ...

› markets › rates-bondsUnited States Rates & Bonds - Bloomberg Treasury Inflation Protected Securities (TIPS) Name Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year . 1.63: ... Rate Current 1 Year Prior; FDFD:IND . Fed Funds Rate . 3.82:

Treasury's Certified Interest Rates — TreasuryDirect Treasury's Certified Interest Rates include Federal Credit Similar Maturity Rates, the Prompt Payment Rate, and Interest Rates for Various Statutory Purposes. Federal Credit Similar Maturity Rates Prompt Payment Rate Current Value of Funds Rate Interest Rates for Various Statutory Purposes

Treasury Bonds — TreasuryDirect Treasury Bonds are not the same as U.S. savings bonds EE Bonds, I Bonds, and HH Bonds are U.S. savings bonds. For information, see U.S. Savings Bonds. Bonds at a Glance Latest Rates 20 Year Bond 3.375% Issued 09/30/2022. Price per $100: 93.835989. CUSIP 912810TK4. 30 Year Bond 3.000% Issued 09/15/2022. Price per $100: 90.579948. CUSIP 912810TJ7.

Treasury Bill Rates - Nasdaq The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also...

Resource Center | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. ... Select type of Interest Rate Data. Select Time Period. Date 20 YR 30 YR Extrapolation Factor 4 WEEKS BANK DISCOUNT COUPON EQUIVALENT 8 WEEKS BANK DISCOUNT COUPON EQUIVALENT 13 WEEKS BANK …

home.treasury.gov › interest-rates › TextViewResource Center | U.S. Department of the Treasury coupon equivalent 8 weeks bank discount coupon equivalent 13 weeks bank discount coupon equivalent 17 weeks bank discount coupon equivalent 26 weeks bank discount coupon equivalent 52 weeks bank discount coupon equivalent 1 mo 2 mo 3 mo 4 mo 20 yr 30 yr; 01/02/2002: n/a : n/a : n/a : 1.71 : 1.74 : n/a : n/a

› market-data › bondsTreasuries - WSJ Market Data Center on The Wall Street Journal.

home.treasury.gov › policy-issues › financialOFAC Recent Actions | U.S. Department of the Treasury Statement by Secretary of the Treasury Janet L. Yellen on the Disbursement of $4.5 Billion in Direct Budget Support for Ukraine November 20, 2022 Statement by Secretary of the Treasury Janet L. Yellen on Election of the President of the Inter-American Development Bank

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present TNC Treasury Yield Curve Forward Rates, Monthly Average: 1976-Present TNC Treasury Yield Curve On-the-Run Par Yields, Monthly Average: 1986-Present TNC Treasury Yield Curve Spot Rates, End of Month: 1976-1977

Risk-Free Rate - Know the Impact of Risk-free Rate on CAPM Below is a chart of historical U.S. 3-month T-bill rates: Source: St. Louis Fed. T-bills fell as low as 0.01% during the 1940s and 2010s and rose as high as 16% during the 1980s. High T-bill rates usually signal prosperous economic times when private sector companies are performing well, meeting earnings targets, and increasing stock prices ...

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Treasury Bills — TreasuryDirect If you write to us and want a response, please put your address in your letter (not just on the envelope). Department of the Treasury Bureau of the Fiscal Service Attention: Auctions 3201 Pennsy Drive, Building E Landover, MD 20785 Call Us For general inquiries, please call us at 844-284-2676 (toll free) E-mail Us

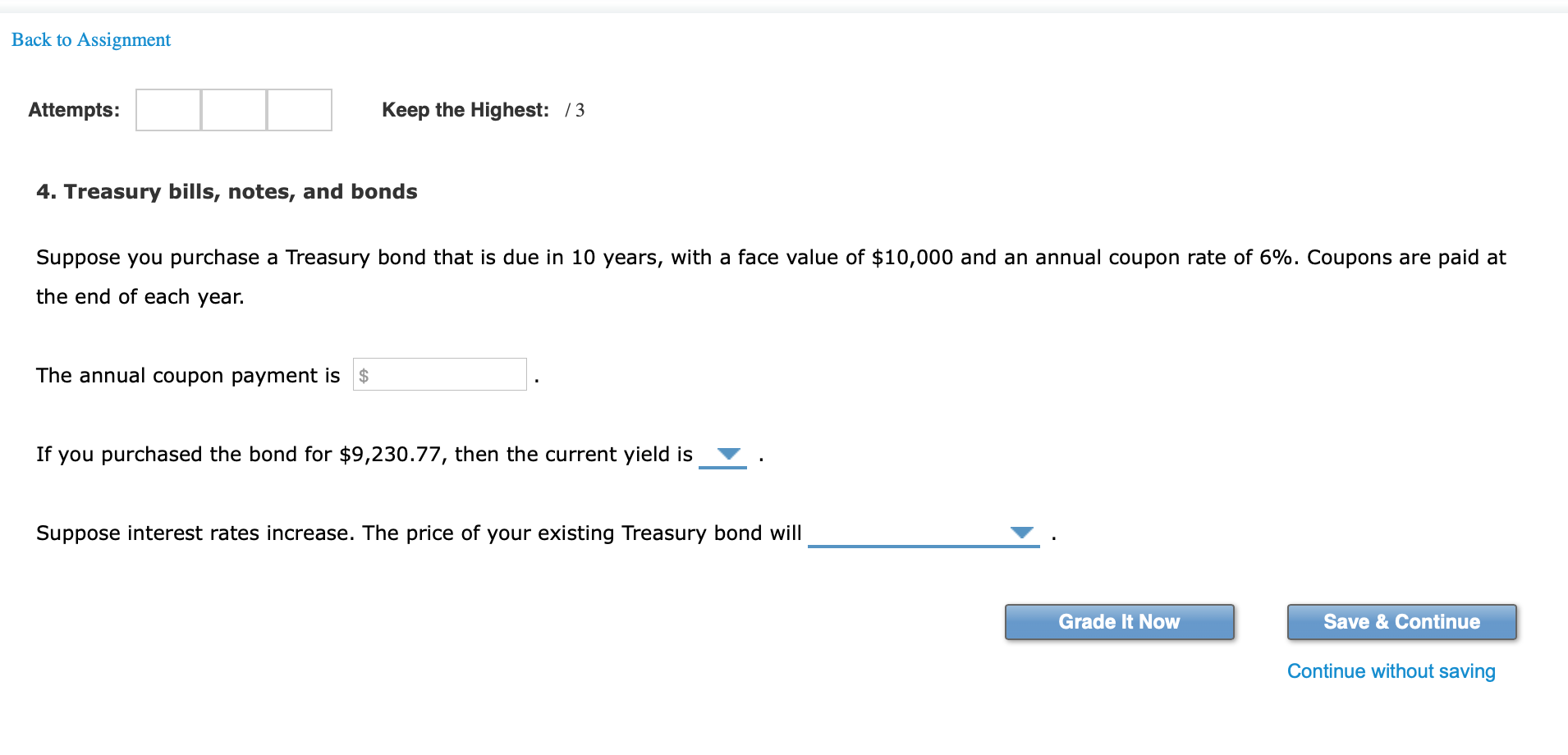

Treasury Bonds vs. Treasury Notes vs. Treasury Bills: What's the ... Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ...

What are coupons in treasury bills/bonds? - Quora Treasury bills do not have a coupon rate; they are sold at a discount and redeemed at face value, also known as par value. Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually.

Treasury Notes — TreasuryDirect Maximum purchase. $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency. 2, 3, 5, and 7-year notes: Monthly. 10-year notes: Feb., May, Aug., Nov. Reopenings of 10-year notes: 8 times/year. See the Auction calendar for specific dates.

Treasuries - WSJ Market Data Center on The Wall Street Journal.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/e27/e270d5a8-78a8-4494-b4e5-34ea83f2212f/php46N91z.png)

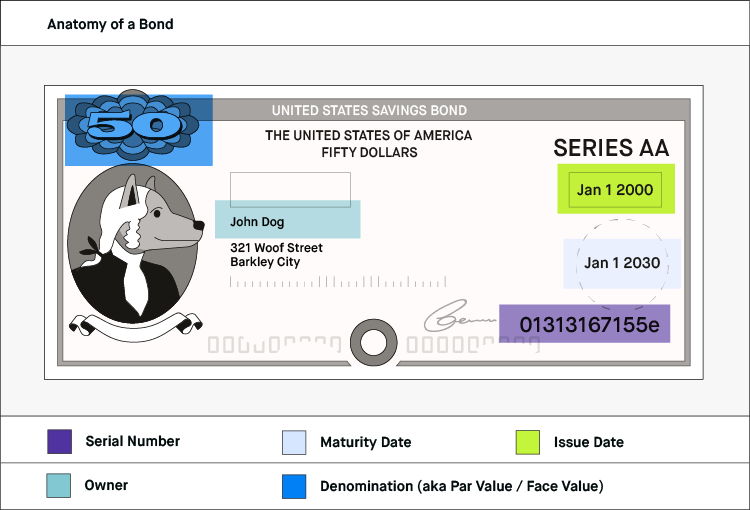

:max_bytes(150000):strip_icc()/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

Post a Comment for "38 treasury bills coupon rate"