40 t bill coupon rate

T-Mobile & Sprint merged to create America's 5G leader in coverage Calls in 215+ countries and destinations, including over Wi-Fi, are $.25/min. (no charge for Wi-Fi calls to US, Mexico, and Canada). Up to 5GB high-speed data, then unlimited at up to 256 Kbps. Additional charges apply in excluded destinations; see ‑Mobile.com for included destinations (subject to change at T‑Mobile's discretion). Individual - Treasury Bills - TreasuryDirect Rates & Terms · Treasury bills are issued for terms of 4, 8, 13, 26, and 52 weeks. Another type of Treasury bill, the cash management bill, is issued in variable ...

AT&T Internet + AT&T Deals | Broadband Plans & Offers Price for internet 300 for new residential customers & is after $5/mo autopay & paperless bill discount. Pricing for first 12 months only. After 12 mos., then prevailing rate applies. $5/mo discount: Must enroll in autopay & paperless bill at point of sale or within 30 days of service activation to receive discount. Must maintain autopay ...

T bill coupon rate

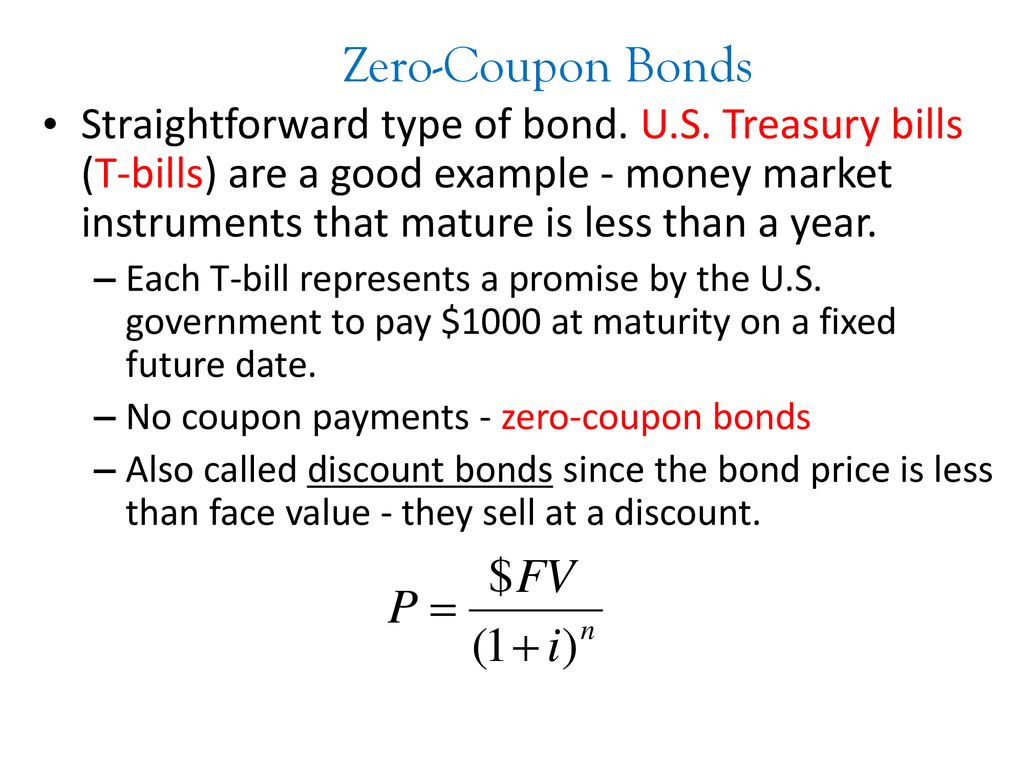

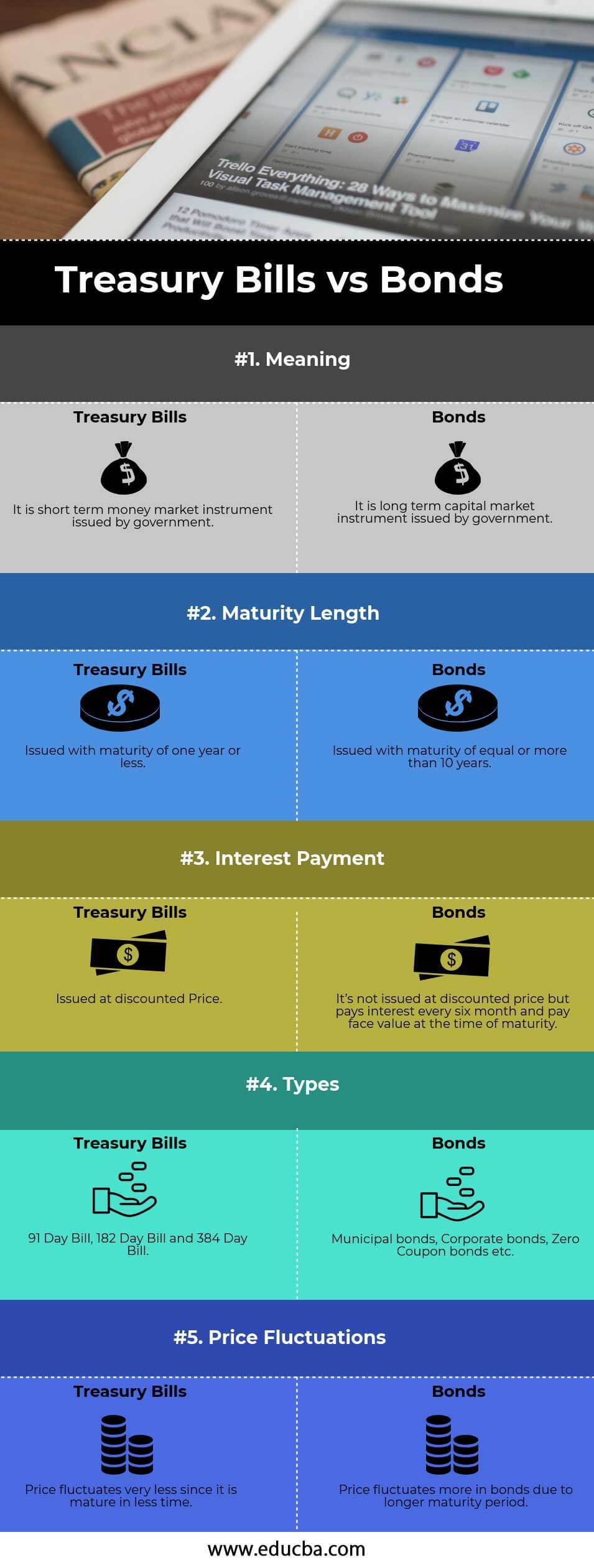

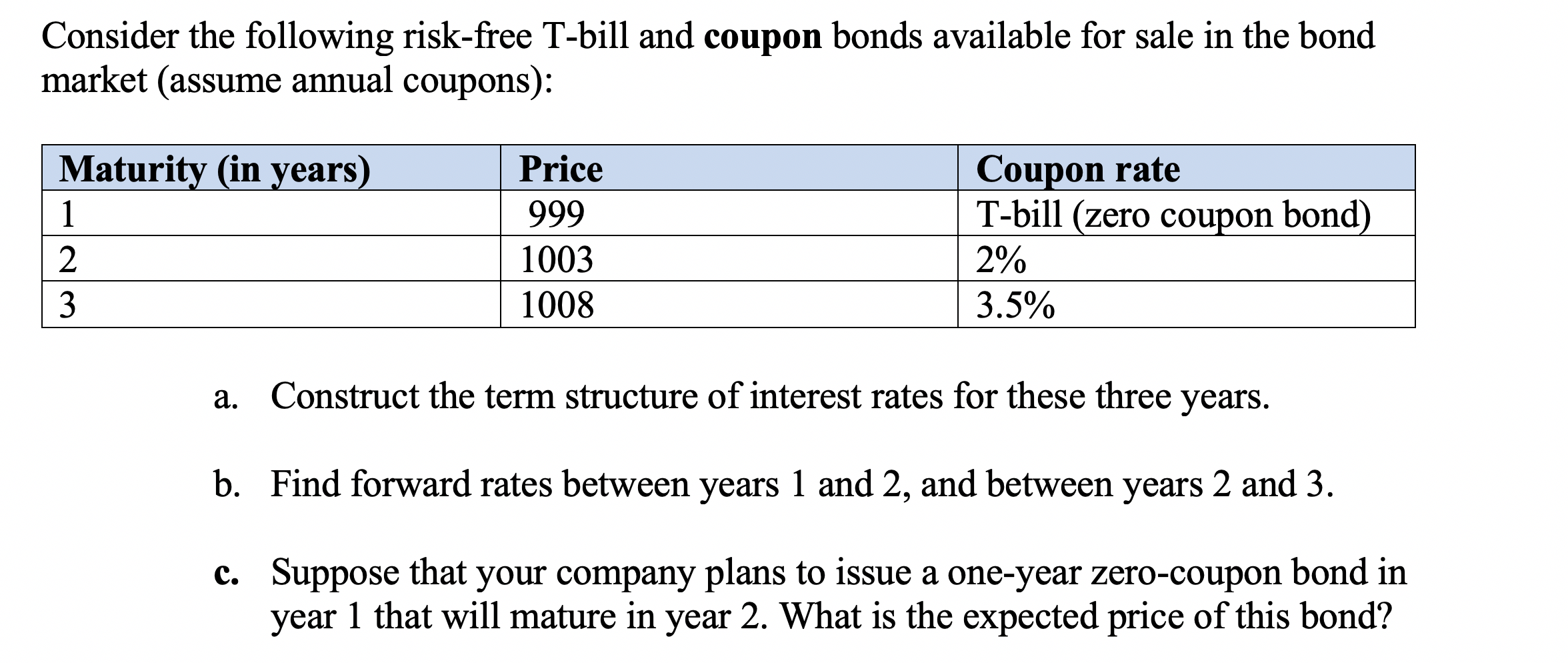

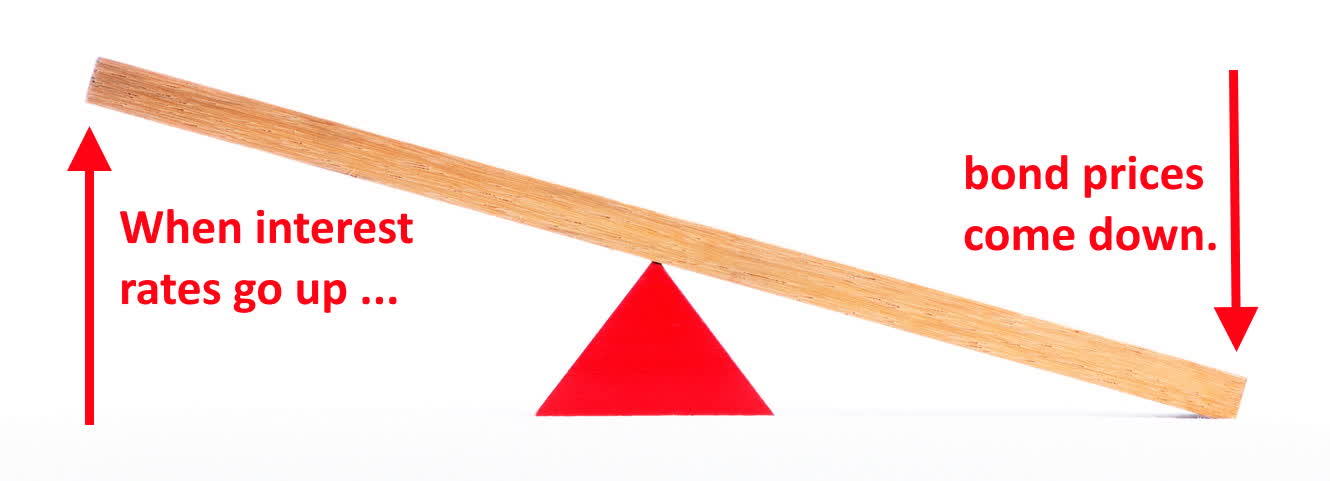

The Basics of the T-Bill - Investopedia There are auctions featuring different maturities every week except the 52-week T-Bill, which is sold every four weeks. 2 For example, a T-Bill with a maturity of 26 weeks might be sold every week... Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000. Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

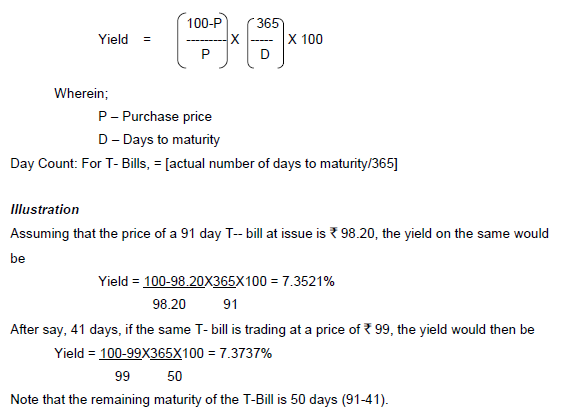

T bill coupon rate. Individual - Treasury Bonds: Rates & Terms Premium (price above par) 30-year bond reopening. Issue Date: 9/15/2005. 3.99%. 4.25%. 104.511963. Above par price required to equate to 3.99% yield. Sometimes when you buy a bond, you are charged accrued interest, which is the interest the security earned in the current semiannual interest period before you took possession of the security. What Are Treasury Bills (T-Bills), and Should You Invest ... - SmartAsset Let's say you purchase a $10,000 T-bill with a discount rate of 3% that matures after 52 weeks. That means you pay $9,700 for the T-bill upfront. Once the year is up, you get back your initial investment plus another $300. If you're interested in investing in T-bills, make sure you aren't looking at treasury bonds or treasury notes. Coupon Equivalent Rate (CER) Definition - Investopedia For example, a $10,000 US T-bill that matures in 91 days is selling for $9,800. Its coupon equivalent rate would be 8.08%, or ( ($10,000 - $9,800) / ($9,800)) * (360 / 91), which is 0.0204 * 3.96.... Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

Understanding Treasury Bond Interest Rates | Bankrate 2 Nov 2021 — Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every ... Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so... How To Read A T-Bill Quote - Investopedia The bidprice represents the interest ratethe buyer wants to be paid for the bond. Converting the bid into an actual price requires a bit of work. 4*100/360=$1.11 $10,000-$1.11=$9,998.89 In this... Understanding Pricing and Interest Rates — TreasuryDirect A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27; ... Now, multiply your inflation-adjusted principal by half the stated interest (coupon) rate on your security. The resulting number is your semi-annual interest payment.

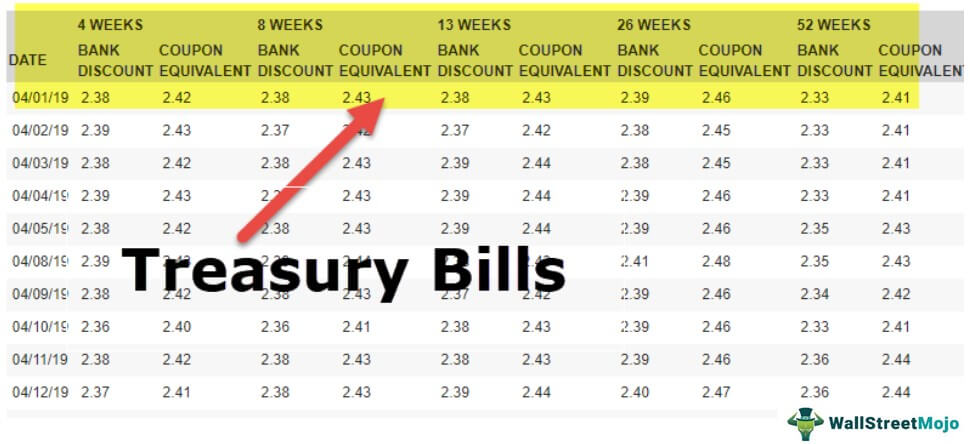

Our Best Cell Phone Deals & Device Promotions | T-Mobile Contact us before cancelling service to continue remaining bill credits, or credits stop & balance on required finance agreement is due (e.g., OnePlus Nord N10 5G - $299.99 / One Plus Nord N200 5G - $216.00 / T-Mobile REVVL V+ 5G - $199.99 / Moto g play - $150.00 / Moto one 5G ace - $264.00 / Moto g pure - $156.00 / Moto g stylus 5G - $252.00 ... Individual - Treasury Bills: Rates & Terms Treasury bills are offered in multiples of $100 and in terms ranging from a few days to 52 weeks. Price and Interest Bills are typically sold at a discount from the par amount (par amount is also called face value). The price of a bill is determined at auction. Using a single $100 investment as an example, a $100 bill may be auctioned for $98. What Are Treasury Bills (T-Bills) and How Do They Work? T-bills are short-term government debt instruments with maturities of one year or less, and they are sold at a discount without paying a coupon. T-Notes represent the medium-term maturities of 2,... US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box.

Treasury Bills - Guide to Understanding How T-Bills Work The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills

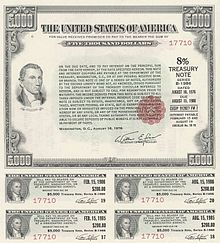

Individual - Treasury Notes: Rates & Terms 3.99%. 4.25%. 102.106357. Above par price required to equate to 3.99% yield. Sometimes when you buy a Note, you are charged accrued interest, which is the interest the security earned in the current interest period before you took possession of the security. If you are charged accrued interest, we pay it back to you as part of your next ...

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch TMUBMUSD01Y | A complete U.S. 1 Year Treasury Bill bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

M&T Bank Promotions: Top 2 Offers for October 2022 What to Open at M&T Bank. 12-month or 24-month CD. M&T offers a great rate for their Select Promo CDs of 12-month or 24-month term. The minimum to open is $1,000. This opening deposit cannot be money already on deposit at M&T Bank. EZChoice Checking. This is M&T's free checking option. It has no monthly service fee or minimum balance requirements.

How Are Treasury Bill Interest Rates Determined? - Investopedia For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the...

United States - Treasury Bills: 26-week - High rate - economy.com Treasury Bills: 26-week - High rate for United States from U.S. Bureau of Public Debt for the Treasury auctions - 13- and 26-week (91- and 182-day) T-Bills release. ... but the coupon payments and underlying principal are adjusted to compensate for inflation as measured by the CPI. Therefore, the real rate of return is guaranteed, but the cost ...

Switch to T-Mobile from Verizon or AT&T & Bring Your Phone Plus, our Price Lock guarantee means that unlike other carriers, we won’t raise the price of your rate plan—and we’ll give you even more great benefits. With 3 lines on Essentials, Magenta, or MAX. Savings with T-Mobile 3rd line free via mo. bill credits vs. comparable available plans; plan features and taxes & fees may vary.

Treasury Bills (T Bills): Definition, Rates & Maturity 10 Mar 2022 — Coupon rate: The interest rate paid on the bond and is a percentage of the face value. For example, a bond having a coupon rate of 5% and a face ...

T-bills: Information for Individuals - Monetary Authority of Singapore What It Is Good For. Use T-bills to: Diversify your investment portfolio. Receive a fixed interest payment at maturity. Invest in a safe, short-term investment option. The price of SGS T-bills may rise or fall before maturity. If you want the flexibility of getting your full investment back in any given month, consider Singapore Savings Bonds ...

Discounting - Wikipedia Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee. Essentially, the party that owes money in the present purchases the right to delay the payment until some future date. This transaction is based on the fact that most people prefer current interest to delayed interest …

3 Month Treasury Bill Rate - YCharts The 3 month treasury yield hovered near 0 from 2009-2015 as the Federal Reserve maintained its benchmark rates at 0 in the aftermath of the Great Recession. 3 Month Treasury Bill Rate is at 3.22%, compared to 3.26% the previous market day and 0.04% last year. This is lower than the long term average of 4.17%. Report. H.15 Selected Interest Rates.

Resource Center | U.S. Department of the Treasury The Bank Discount rate is the rate at which a bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year.

Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000.

The Basics of the T-Bill - Investopedia There are auctions featuring different maturities every week except the 52-week T-Bill, which is sold every four weeks. 2 For example, a T-Bill with a maturity of 26 weeks might be sold every week...

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

Post a Comment for "40 t bill coupon rate"