43 yield to maturity of zero coupon bond

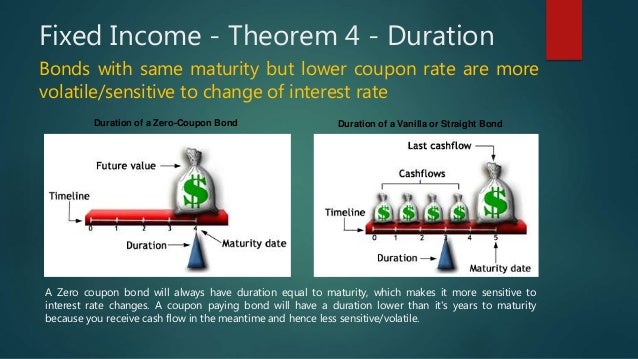

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Calculator Bond Duration Portfolio Bond Calculator § For example, a bond with a duration of 7 will gain about 7% in value if interest rates fall 100 bp of Annuity Bond Yield Mortgage Retirement . Zero Coupon Bond Definition Before you make the final decision to finance a property, you need to understand the costs involved, and how much This calculator can help you determine the ...

Yield to Maturity (YTM) - Overview, Formula, and Importance The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they can expect from each. It is critical for determining which securities to add to their portfolios.

Yield to maturity of zero coupon bond

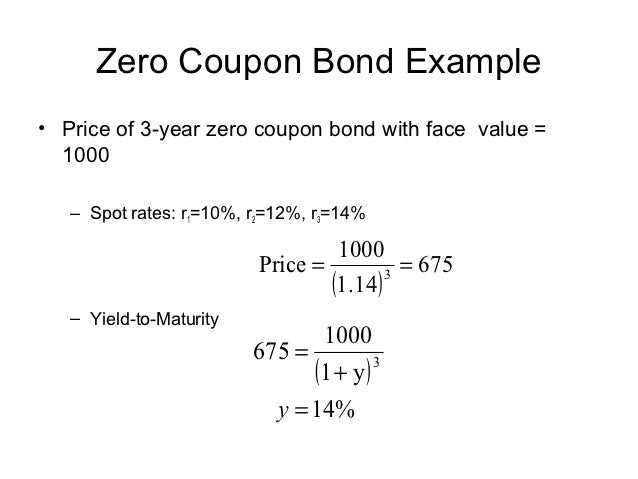

Zero-Coupon Bond Definition - Investopedia The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond and not an established interest rate. For example, a bond with a face... Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

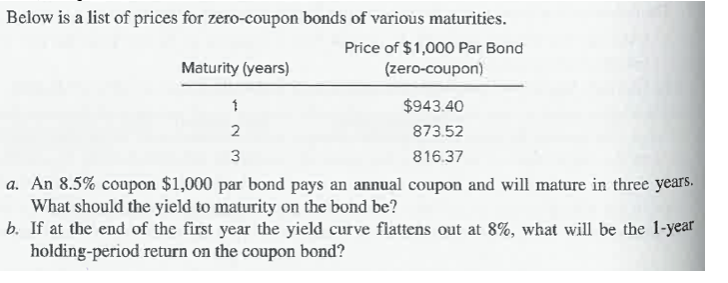

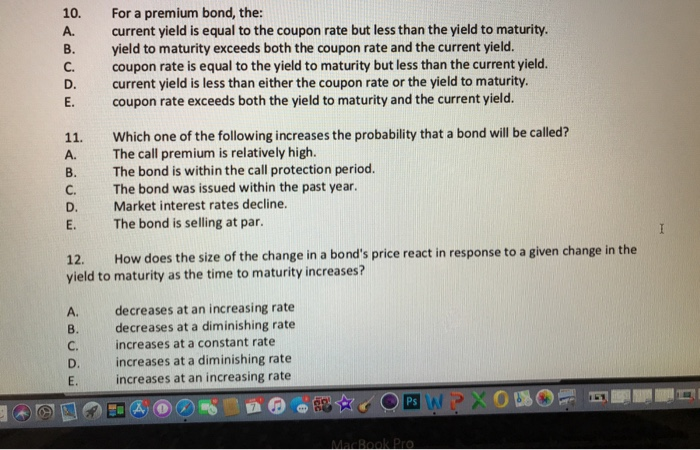

Yield to maturity of zero coupon bond. Chapter 6 - Corporate Finance Given coupon rate and yield to maturity, determine whether a coupon bond will sell at a premium or a discount; describe the time path the bond's price will ...119 pages Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ... 21. The yield-to-maturity of an 8-year zero coupon bond, The yield-to-maturity of an 8-year zero coupon bond, with a par value of $1,000 and a market price of $700, is - Answered by a verified Business Tutor ... Suppose you purchase a 30 -year, zero-coupon bond with a yield to maturity of 6.1 %. You hold the bond for five years before selling it. a.

YIELDS TO MATURITY ON ZERO-COUPON RONDS - Bond Math - Ebrary Its yield to maturity is 5.174% (s.a.). The assumption of two periods in the year, while totally arbitrary, is common in financial markets because the yield on the zero then can be compared directly to yields to maturity on traditional semiannual payment fixed- income bonds. Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ... How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Python Yield Curve Bond Yield curve rates between 1990 and present are from the U (2) Assuming the yield curves yield rates are effective rates, for example, for a yield curve with points (1,4%) and (2,5%) where its (x,y)=(maturity,yield) does this suggest that, one could currently invest in a zero coupon bond and receive a 4% return at the end of the year, and that ... Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

Bond yield formula excel colors and shapes ppt hydraulic cylinder design calculations hydraulic cylinder design calculations

Solved "A zero-coupon bond has a yield to maturity of 5% and | Chegg.com See the answer "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of __________ today. " Expert Answer 100% (1 rating) Bond price of zero coupon bond today = Matu … View the full answer Previous question Next question

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

Yield to Maturity - NYU Stern The higher the coupon, the closer the bond's yield is to the annuity rate. The lower the coupon, the closer the bond's yield is to the zero rate.14 pages

What Is a Zero Coupon Yield Curve? (with picture) The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different periods to maturity. The reason for constructing a zero coupon yield curve is for use as a basic tool in determining the price of many fixed income securities.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Solved 15, A zero-coupon bond has a yield to maturity of 9% | Chegg.com Transcribed image text: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16.

Solutions to Problem Set 2 - Wharton Finance (a) The yield on the bond (assuming annual compounding) is: ... maturity, the yield to maturity for a zero coupon bond is given by: YTM = (F.5 pages

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Zero-Coupon Bond Definition - Investopedia The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond and not an established interest rate. For example, a bond with a face...

Post a Comment for "43 yield to maturity of zero coupon bond"