39 zero coupon bonds formula

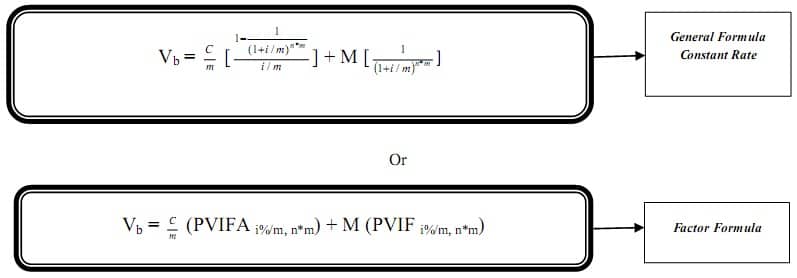

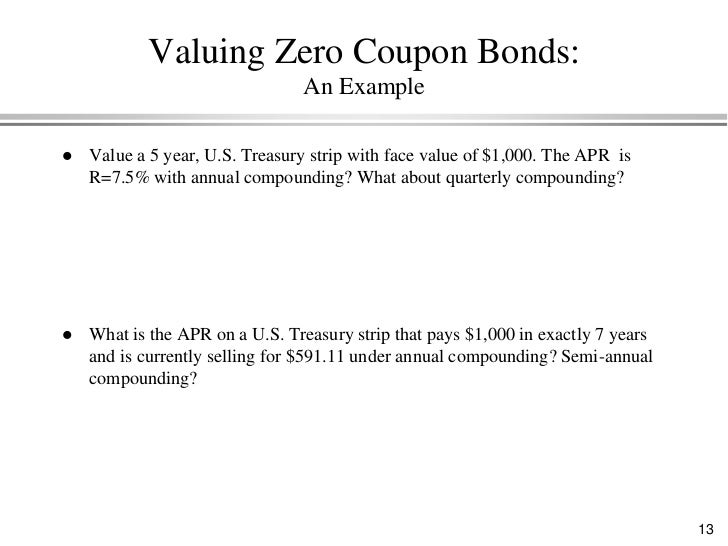

Zero Coupon Bond: Formula & Examples - Study.com Examples of the Zero-Coupon Bond Formula: Example 1: Annual Compounding. Adam wants to invest in a zero-coupon bond with a face value of $1,000 and 9 years to maturity. If the required interest ... Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The formula above applies when zero-coupon bonds are compounded annually. When interest is compounded semi-annually, the same formula will be used, but the number of years will be multiplied by 2. A zero-coupon bond earns interest that is only imputed, which means the interest is merely an estimate instead of an established rate.

Zero-Coupon Bond: Definition, Formula, Example etc. Price of bond = $1,000/ (1+.07)5 = $713.27 Hence, the price that Robi will pay for the bond today is $713.27. Example 2: Semi-annual Compounding Robi is intending to purchase a zero coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 7% compounded semi-annually.

Zero coupon bonds formula

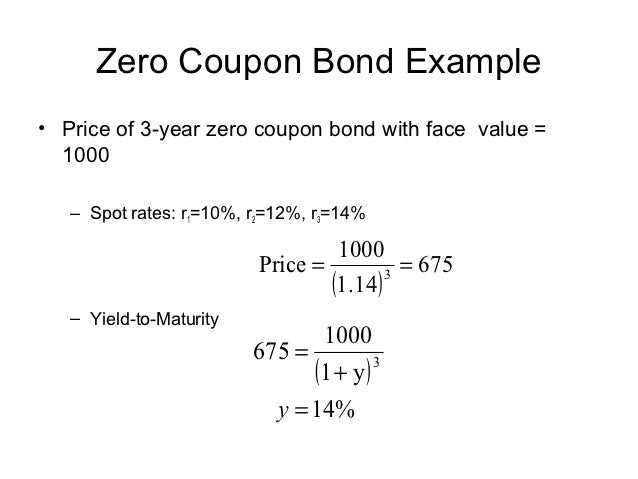

Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

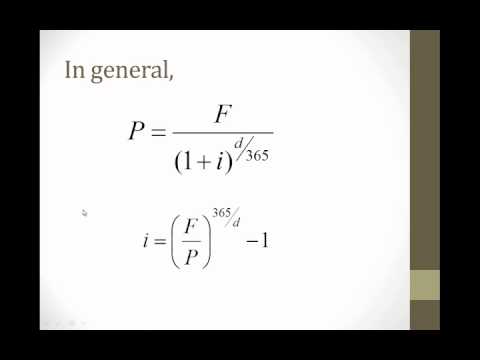

Zero coupon bonds formula. How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%. So we're just taking (1 + the forward rate) for each of these periods. It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five. Zero-Coupon Bond - Definition, How It Works, Formula Calculating the price of zero coupon bond: The yield to maturity formula can be used to calculate the present value of the bond. By rearranging the above formula, the present value of the bond can be calculated as where, PV = Present value of bond FV = Face value of bond (Future value) YTM = Yield to maturity t = Time to maturity The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula P = M / (1+r)n variable definitions: P = price M = maturity value r = annual yield divided by 2 n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term.

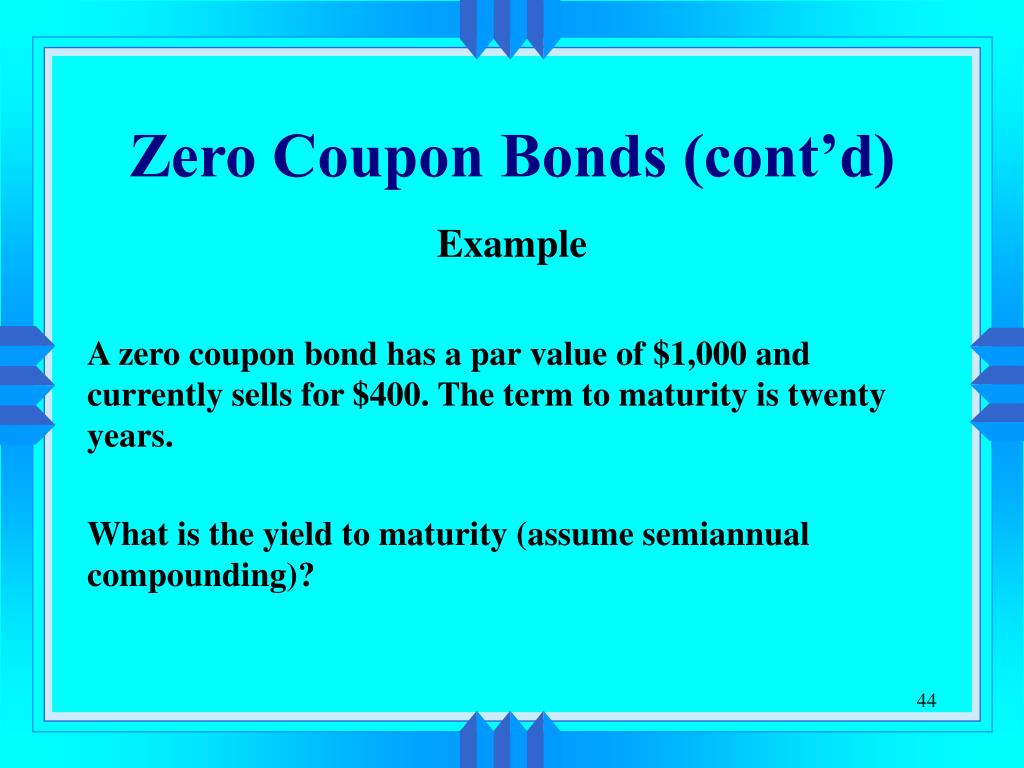

Zero Coupon Bond Yield: Formula, Considerations, and Calculation The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Zero Coupon Bond Value Formula - Crunch Numbers Example of price of a zero-coupon bond calculation Let's assume an investor wants to make 10% of return on a bond. The face value of the bond is $10,000. The bond is redeemed in 5 years. What price the investor would pay for this bond? M = $10,000 r = 10% n = 5 katex is not defined 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Because the actual payment is $20,000 and not $1, the present value of the cash flows from this bond (its price) can be found as follows: present value = future cash payment × $0.8900 present value = $20,000 × $0.8900 present value = $17,800 Bond prices are often stated as a percentage of face value. Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

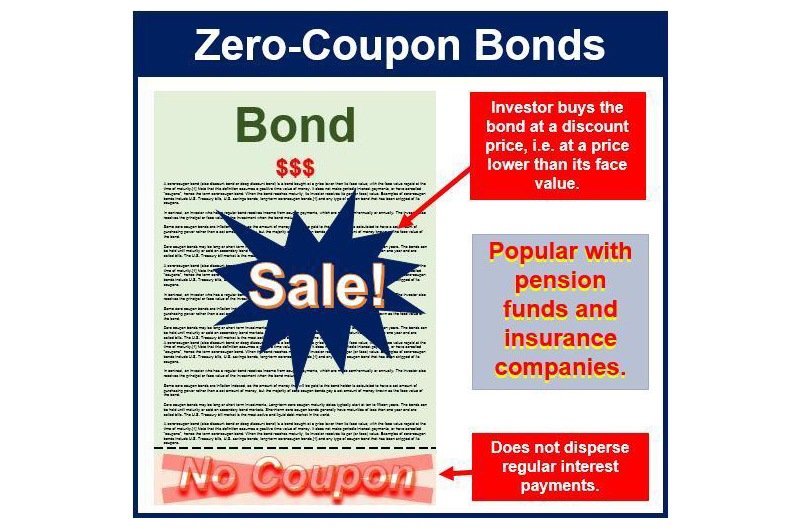

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero Coupon Bond Default Formulas - quantwolf.com Default probability in terms of yield. p = 1 − α 1 − R α = 1 + y 0 T 360 1 + y 1 T 360 y 1 = yield of the bond y 0 = yield of the risk free bond T = number of days to maturity R = recovery rate, between 0 and 1. For zero coupon bonds? Explained by FAQ Blog What is the formula for calculating zero-coupon bond? The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i)^n where: M = maturity value or face value. i = required interest yield divided by 2. Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero-Coupon Bond Yield-to-Maturity (YTM) Formula

Coupon Bond Formula | Examples with Excel Template Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity.

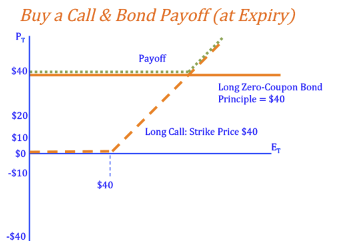

Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... What are Zero-Coupon Bonds? A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is … Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ...

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

How to Buy Zero Coupon Bonds | Finance - Zacks The less you pay for a zero coupon bond, the higher the yield. A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the Treasury...

Zero Coupon Bond Value Calculator - Find Formula, Example & more A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ...

Zero Coupon Bond Yield Calculator - Find Formula, Example & more The yield of the bond will be. The formula is: Zero Coupon Bond Effective Yield = ( (Face Value of Bond / Present Value of Bond) ^ (1 / Period)) - 1. The process of solution we need to use is: Zero Coupon Bond Effective Yield = ( (1000 / 700) ^ (1 / 5)) - 1. Here, the bond will provide the investor with a yield of 7.39%.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Post a Comment for "39 zero coupon bonds formula"